Today, ESOP activity is somewhat limited.

While we are seeing incredible examples of success across the ~250 Employee Stock Ownership Plans (ESOPs) formed each year (particularly amongst the 100% S-Corp ESOPs), we are going to need greater levels of ESOP activity if we are seeking a more inclusive and sustainable economy. This will require both a great number of ESOP formations, as well as a larger average company size for new ESOPs (particularly given the highly effective 100% S-Corp ESOP is most frequently utilized by small businesses).

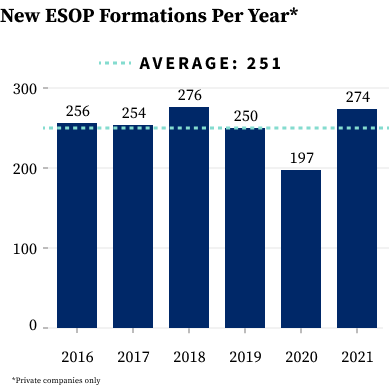

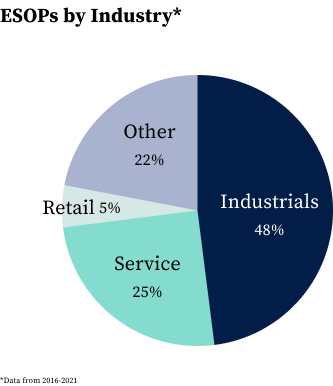

New ESOP formations per year are relatively flat. There is limited accurate long-term historical data, but we do have reliable data back to 2016 such that we can look back a number of years with confidence. As shown in the data below, new ESOP formations per year are steady at 250, but are not growing, and these new formations are concentrated in a few industries.

Source: National Center For Employee Ownership

C-Corp ESOPs, which are applicable to larger businesses, are in decline. It is only a slight over-generalization to say that most ESOP activity comes in one of two forms, 100% S-Corp ESOPs and partial C-Corp ESOPs. The specific details get fairly technical but, as noted earlier, 100% S-Corp ESOPs are most commonly used by smaller businesses with simpler ownership structures, whereas partial C-Corp ESOPs can be used more easily by much larger companies with broadly distributed shareholder bases.

Source: National Center For Employee Ownership, Department Of Labor